Calculate ebitda margin

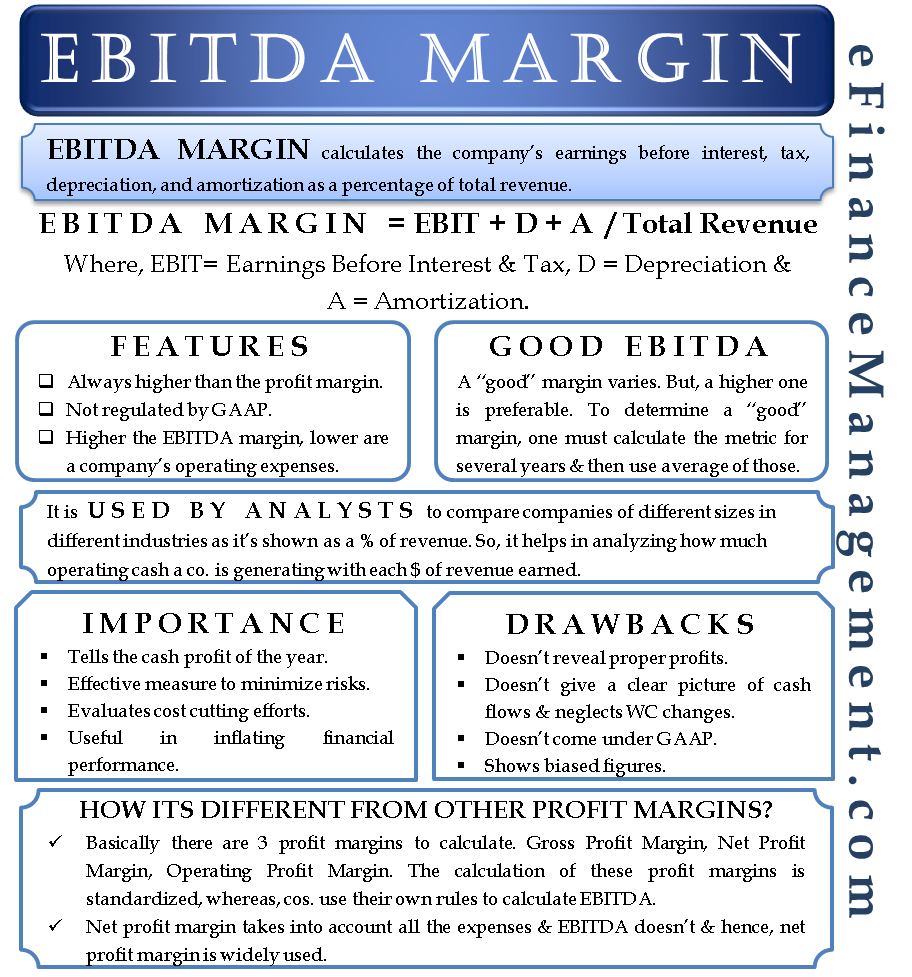

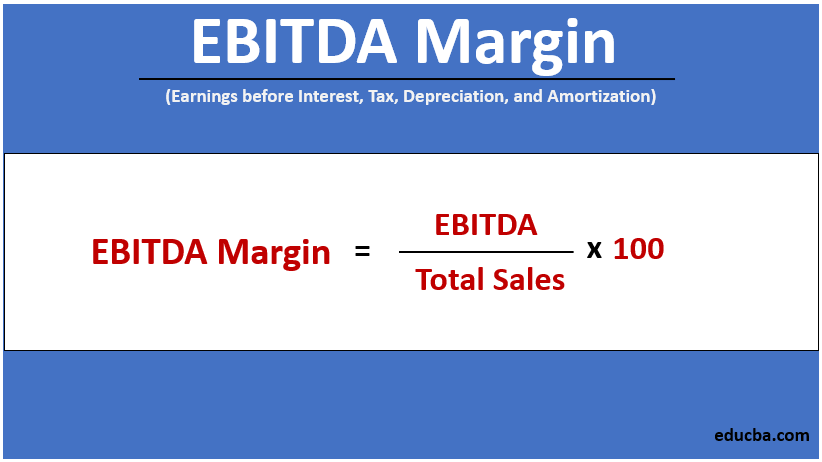

EBITDA margin EBITDASales100. EBITDA total revenue.

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

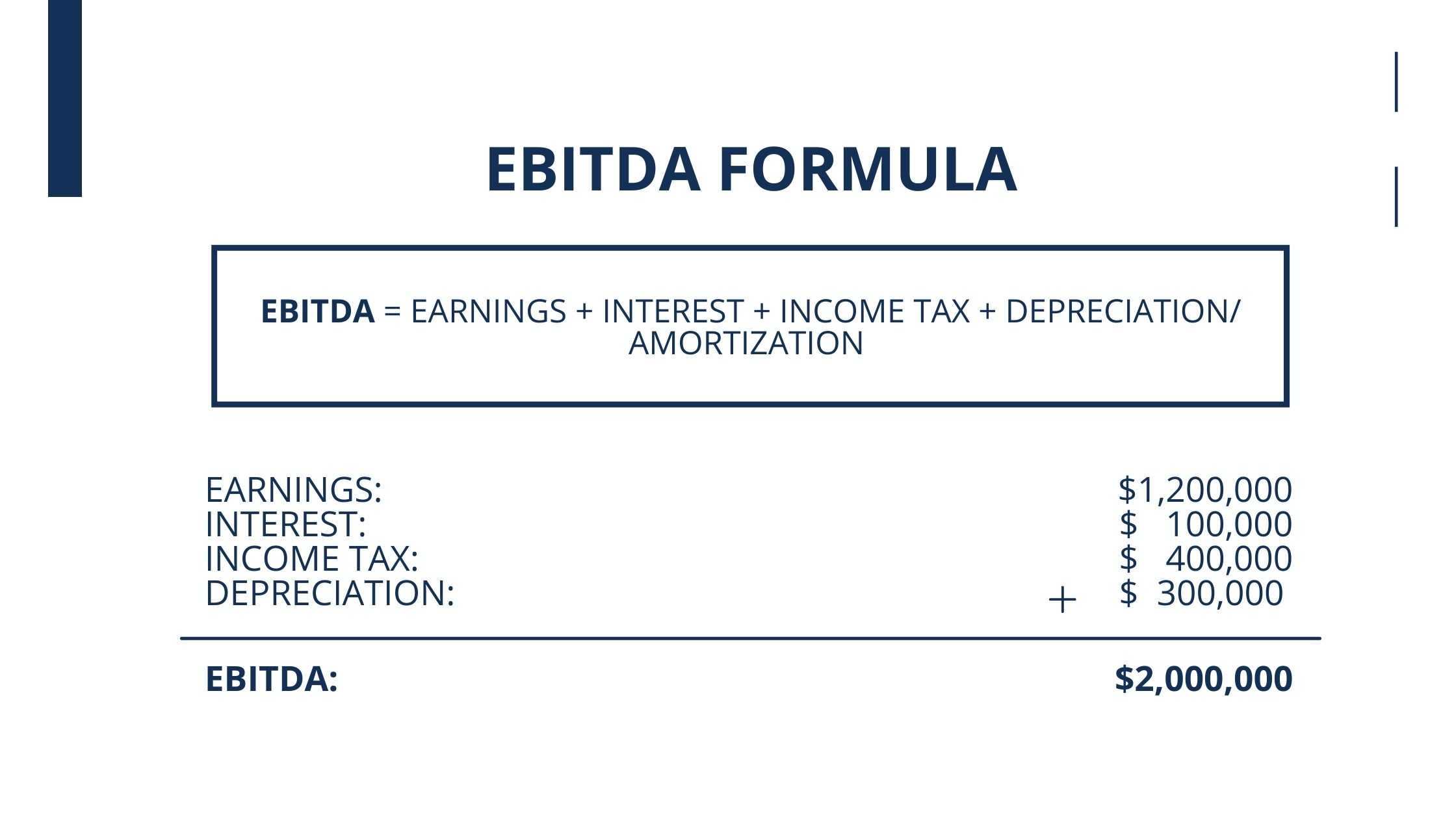

EBITDA Net Income Taxes Interest Expense Depreciation Amortization Unlike the first formula which uses operating.

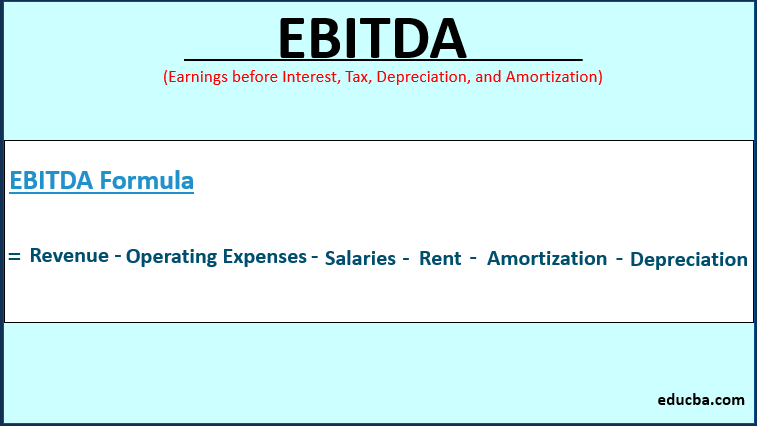

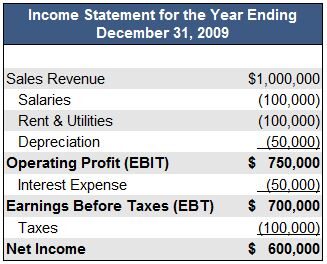

. Let us understand this calculation with a simple example. EBITDA margin earnings before interest and tax depreciation amortization total revenue That makes it easy to compare the relative profitability of two or. Earnings before interest taxes depreciation amortizationtotal revenue Calculating the EBITDA margin is.

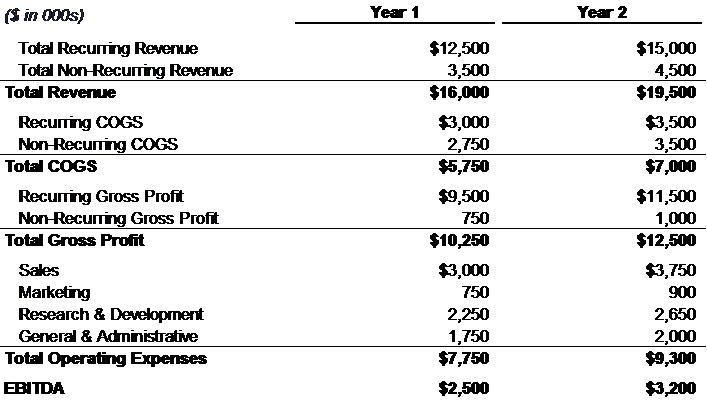

Company A Using the formula as above EBITDA of the company Net sales- raw material. Suppose a companys revenues are Rs. EBITDA Margin EBITDA Total Revenue.

The formula for EBITA margin is. EBITDA net income interest expenses tax depreciation amortization The EBITDA margin is usually a percentage found using the formula. EBITDA Net income interest expenses tax depreciation amortization.

The formula for measuring EBITDA is. The formula for EBITDA margin is. EBITDA net incomeinterest expensetax expensedepreciationamortization EBITDA Marginfrac EBITDA revenue EB I T DA.

The first one is based on net income such that. The second formula for calculating EBITDA is. EBITDA Margin EBITDA Revenue For instance suppose a company has generated the following results in a given period.

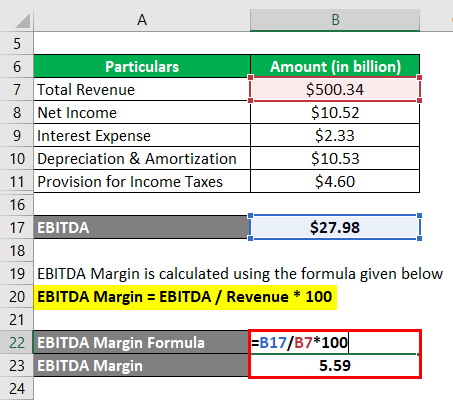

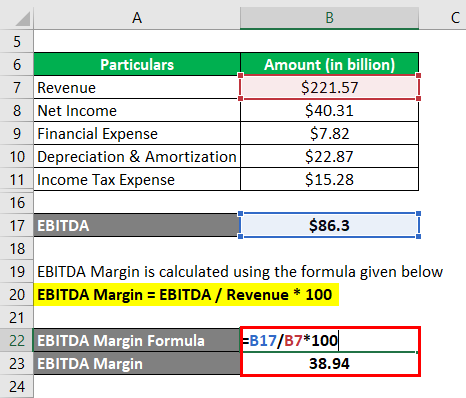

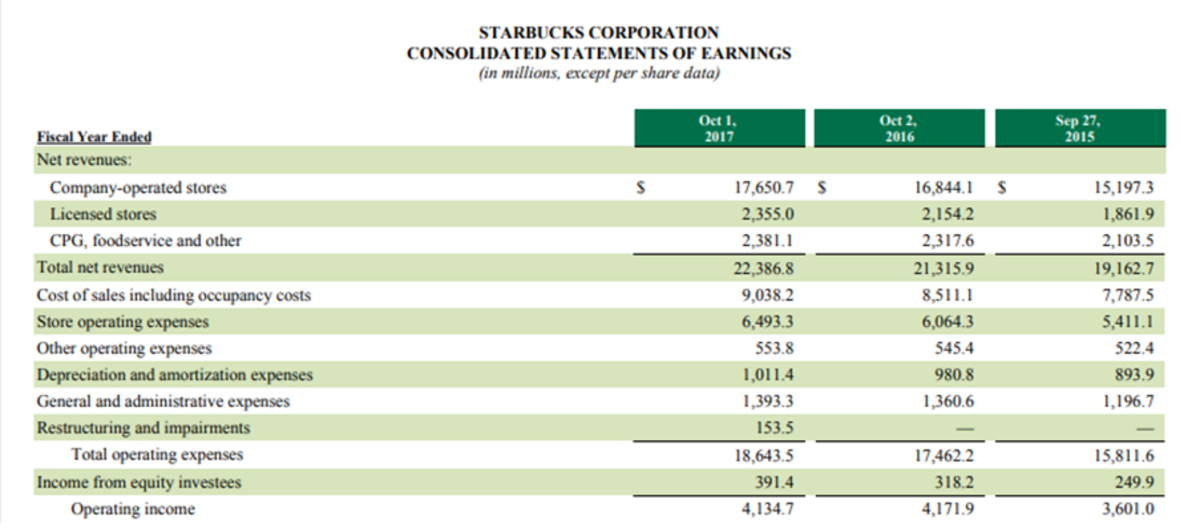

EBITDA Net Income Interest Taxes. EBITDA margin 1800000 200000 10000000 20 Company B. EBITDA Margin is calculated using the formula given below EBITDA Margin Total Sales COGS Operating Expenses DA Expense Total Sales EBITDA Margin 50034 billion.

EBITDA Margin Formula The EBITDA formula is pretty basic. EBITA Marginfrac net incomeinterest expensetax expenseamortization revenue EB I T A M argin revenuenet income interest expense. A high EBITDA percentage means your company has less operating expenses and higher earnings which shows that you can pay your operating costs and still have a decent amount of.

EBITDA margin 1800000 900000 10000000 27 Although both companies have. 10 million Cost of Goods Sold Direct Costs. The formula for calculating EBITDA EBITDA can be calculated using a series of formulas.

What Is A Good. EBITDA Net Income Interest Taxes Depreciation Amortization Expenses EBITDA 150000 9000 17000 4000 6000 EBITDA 186000 Now using EBITDA. You can utilize our EBITDA calculator to do EBITDA margin calculation or simply stick with the given formula.

Ebitda Margin Features Importance Drawbacks Other Profit Margins

How To Calculate Ebitda Margin

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

What Is An Ebitda Margin Examples And How To Calculate Thestreet

Ebitda Margin Formula And Calculator Excel Template

Ebitda Margin Formula Meaning Interpretation With Examples

Ebitda Margins What Every Small Company Owner Needs To Know

Ebitda Types And Components Examples And Advantages Of Ebitda

Ebitda Margin Definition Example Investinganswers

What Is An Ebitda Margin Examples And How To Calculate Thestreet

Ebitda Margin Formula Definition And Explanation

What Is Ebitda Formula Example Margin Calculation Explanation

Ebitda Margin Formula Meaning Interpretation With Examples

How To Build And Use Ebitda Bridges Waterfalls By Ramin Zacharia Medium

How Do I Calculate An Ebitda Margin Using Excel

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Margin Formula And Calculator Excel Template